The GP Stakes Fund

What is a GP Stake?

A “GP Stake” is a minority ownership position of a private market asset manager including Private Equity, Private Credit and Real Estate firms. These managers are known as the General Partners (or GPs) while their clients are considered Limited Partners (or LPs).

Owning a GP Stake allows investors to sit shoulder-to-shoulder with the manager and thus share the management company’s potential revenue, including fees from all the funds it manages, both past, present and future.

The CAZ General Partner Stakes Fund (“GPS”)

Multiple Paths to Revenue

Seeks current income created by potential cash flows generated from management fees, carried interest and balance sheet revenues of the underlying firms

Targets Growth & Income

Upside optionality from the increase in enterprise value, as private managers continue to grow their businesses

Structured Redemptions

Access to private market investments with a structured redemption process

Downside Mitigation

Targets downside mitigation and potentially consistent revenue generation through contractually obligated management fees

TAX AWARE INVESTING

It’s not what you make,

it’s what you keep.

The CAZ GP Stakes Fund is built around one core principle:

investors compound wealth after tax, not before.

While many funds highlight pre-tax returns, CAZ focuses on the results investors actually keep. The Fund’s registered structure requires post-tax performance reporting, offering a clearer and more transparent view of real economic outcomes. Importantly, GP stakes can be inherently tax-efficient, benefiting from significant amortization that can materially reduce tax liabilities (at the fund level) over time.

The companies listed above represent a partial list of firms which CAZ investments has an established investment relationship and are not intended to represent any existing holdings within the fund. These companies are not affiliated with Ultimus Fund Distributors, LLC.

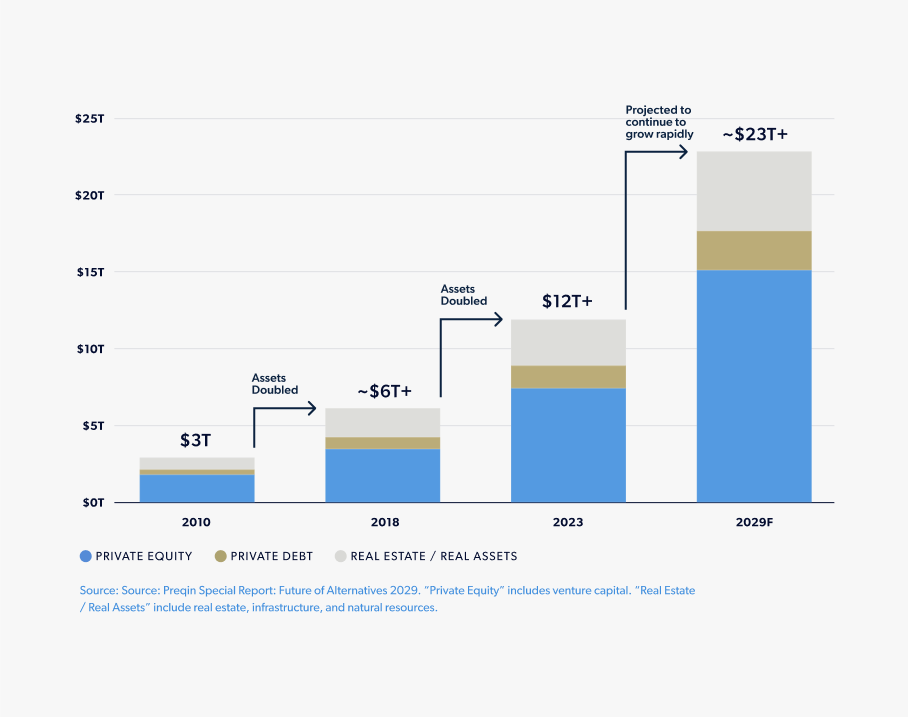

Assets Allocated to Private Markets Continue to Grow Rapidly

How GP Stakes Work in 4 Steps

The Asset Manager

An established private asset manager from private equity, private credit or real estate, sells a minority stake in its own business.

The Investor

A GP stakes investor, in this case the CAZ GP Stakes Fund, buys a minority and passive stake and becomes a part-owner of the management company itself.

Revenue Streams

The investor participates in the company's earnings which includes management fees: A recurring fee charged by the firm on the total assets under management as well as performance fees which are often 20% of the total performance of their underlying funds.

Wide Exposure

By investing in a GP stake, the investor is indirectly invested in all the funds the management company currently manages and will launch in the future, providing diversification across different strategies, vintages and geographies.

Investors should consider the investment objectives, risks, and charges and expenses of the Fund(s) before investing. The prospectus {and, if available, the summary prospectus,} contains this and other information about the Fund(s) and should be read carefully before investing. The prospectus may be obtained at (855) 886-2307 or www.cazgpstakesfund.com.

The Fund should be considered a speculative investment and entails substantial risks, and a prospective investor should invest in the Fund only if it can sustain a complete loss of its investment.

Risk Considerations

The Fund is newly formed and has limited operating history. Investing in Shares involves a high degree of risk. The Fund should be considered a speculative investment and entails substantial risks, and a prospective investor should invest in the Fund only if it can sustain a complete loss of its investment.

Unlike many closed-end funds, the Shares are not listed on any securities exchange. To provide Shareholders with limited liquidity, the Fund intends to conduct repurchases of Shares in each quarter and expects to make its initial repurchase within two full quarters after commencement of operations.

The Fund's distributions may be funded from unlimited amounts of offering proceeds or borrowings, which may constitute a return of capital and reduce the amount of capital available to the Fund for investment. Any capital returned to shareholders through distributions will be distributed after payment of fees and expenses. A return of capital to shareholders is a return of a portion of their original investment in the Fund, thereby reducing the tax basis of their investment. As a result of such reduction in tax basis, shareholders may be subject to tax in connection with the sale of Fund Shares, even if such Shares are sold at a loss relative to the shareholder's original investment.

The Fund is non-diversified, which means it is permitted to invest a greater portion of its assets in a smaller number of issuers than a "diversified" fund. For this reason, the Fund may be more exposed to the risks associated with and developments affecting an individual issuer than a fund that invests more widely. The Fund may also be subject to greater market fluctuation and price volatility than a more broadly diversified fund. Please refer to the fund's prospectus for these and other important risk considerations.

Investing involves risk, including loss of principal. The value of the fund's shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results.

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

There is a risk that issuers and counterparties will not make payments on securities and other investments held by the Fund, resulting in losses to the Fund.

The "CAZ General Partners Stakes Fund" is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

CAZ Investments does not provide tax advice. Please consult your tax advisor before making any decisions or taking any action based on this information.

CAZ Investment Registered Adviser, LLC is not affiliated with "Ultimus Fund Distributors, LLC."